In the past few weeks, we have seen a constant reshuffling of the top 10 rankings of cryptocurrencies according to market capitalization.

Only a few days ago, we saw Tron (TRX) make an entry into the top 10 riding on the wave of investor interest created by the BitTorrent (BTT) token sale and airdrop.

TRX is currently ranked 8th according to market cap. Binance Coin (BNB) is currently ranked 10th after edging out Bitcoin SV (BSV) and due to the team at the exchange constantly BUIDLing and updating on developments.

LTC Leading the Pack in Gains

Further going up the rankings, we find that Litecoin (LTC) has had a major boost from news that the Litcoin foundation aims at implementing Confidential transactions by using the Mimblewimble protocol. On its way up, LTC has edged out Bitcoin Cash and EOS. The Litecoin network is also scheduled for a halving event this August.

A Battle for Number 2

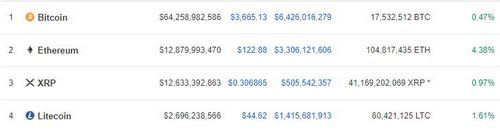

Constantly at the top is the King of Crypto: Bitcoin.

The number 2 spot according to market capitalization has been a constant battle between Ethereum and XRP. The latter coin has also benefited from news that more financial institutions will be using xRapid that utilizes the liquidity provided by XRP.

In the case of Ethereum (ETH), its fluctuation in value can be attributed to three things.

Firstly, the bear market brought with it serious blowback from the ICO boom of 2017/2018 as many projects were reported to be liquidating their ETH to stay afloat financially. Secondly, the continual scrutiny of ICOs by regulatory bodies across the globe has directly affected the value of ETH as more and more projects are reluctant to carry out public sales. This has in turn reduced the demand for ETH in the markets. Many crowdfunding projects are carrying out private rounds of funding and/or excluding US residents from such investment opportunities due to the SEC.

Thirdly, the continual postponement of the Constantinople upgrade has had a noticeable effect on the value of ETH. The upgrade has been pushed forward on two separate occasions. Back in October, the upgrade was not properly activated by miners leading for a new date to be set for January 16th this year. A few days before the set January date, a security vulnerability was discovered thus pushing the upgrade to February 27th.

Constantinople Effect on ETH

Checking our calendars, the date of the 27th is only 16 days awa. Perhaps the proximity to this date has led to the renewed interest in ETH in the crypto markets. The King of Smart Contracts is currently valued at $122 and looks set to continue the climb up as we approach the date of the upgrade. Approximately $246 Million in market cap separate ETH and XRP at the moment of writing this.