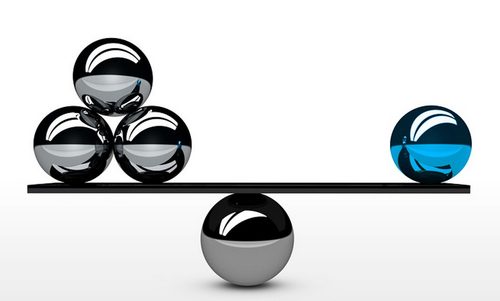

Margin Trading Is Profitable but Can Also Exaggerate Losses

Lennix Lai, Financial Market Director of OKEx, explained that the exchange is one of the few that offers 5x leverage. He expressed confidence in the exchange’s risk management engine driven by long-standing trading data. He also cautioned traders on the risks associated with leverage trading.

The beauty of margin trading is to use debt to maximize the potential return.

Yet, I would like to remind our users to trade margin with caution. Because margin would as well exaggerate your losses.

In 2019, we will continue to lead the industry and offer further products that reflect the market needs.

Malta based OKEx crypto exchange earlier today announced that it had increased the leverage option for 9 trading pairs from 3x to 5x. According to the exchange, the increment is due to market demand for higher leverage during trading of the following trading pairs.

- BTC/USDT

- ETH/USDT

- ETH/BTC

- LTC/USDT

- LTC/BTC

- ETC/USDT

- ETC/BTC

- EOS/USDT

- EOS/BTC

The exchange is yet to increase the margin trading leverage for TRX.

Risk Ratio and Margin Call Ratio of The Trading Pairs

The exchange also explained that the surplus balance in the margin account can be transferred out through ‘funds transfer’ under the following risk ratio conditions.

- 5x leverage – risk ratio is ≥125%

- 3x leverage – risk ratio is ≥150% (remains unchanged)

The estimated margin call ratio of all trading pairs will be adjusted to 120%. When the risk system sees that a trading position has a risk ratio that is ≤120%, it will notify the user automatically via SMS. The margin call ratio remains at 110% and when the risk ratio is is ≤110%, forced liquidation will be initiated by the system and the user will also get a notification SMS.

The Risk Ratio formula on OKEx is calculated as follows:

Risk Ratio = (Total Assets (In Base Currency) – Interests Payable (In Base Currency) ) / Last Trade Price + (Total Assets (In Trading Currency) – Interests Payable (In Trading Currency)/(Borrowed Assets (In Base Currency) / Last Trade Price + Borrowed Assets (In Trading Currency) ) * 100%