The US Securities and Exchange Commission (SEC) has reportedly begun probing cryptoasset hedge funds as part of its wider clampdown on initial coin offerings (ICO) that violate federal securities regulations.

Citing three people familiar with the matter, Bloomberg reports that the SEC has made inquiries to a number of cryptoasset hedge funds seeking information about their business operations.

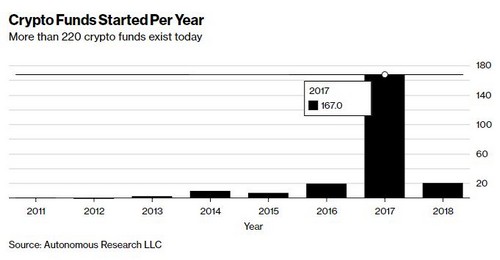

There are currently more than 220 hedge funds devoted to the cryptoasset space, and 187 of those funds have opened since the beginning of 2017. Because most of these firms manage less than $150 million worth of assets, they do not have to register with the SEC and are instead regulated at the state level.

The sources familiar with the probe said that regulators want to know what methodology funds use to evaluate and price their cryptoasset investments – which often include stakes in ICO tokens – as well as their custodial policies.

However, the publication also reports that the SEC’s Enforcement Division has issued subpoenas to other funds, perhaps indicating that regulators believe these funds have run afoul of federal securities regulations.

In these cases, the SEC is apparently interested in identifying the relationships between the hedge funds and ICO operators. They also want to know whether fund managers have personally invested in the ICO tokens held by the fund without making proper disclosures.

Word of the SEC’s probe into cryptoasset hedge funds comes as the agency has been ramping up its enforcement of the ICO industry. SEC Chairman Jay Clayton has repeatedly stated that the vast majority of ICOs he has observed constitute unregistered securities offerings, and the agency has fired an increasing number of warning shots in an attempt to encourage industry participants to comply with regulations.

Earlier this month, reports emerged that the SEC had subpoenaed “dozens” of ICO operators and advisers and had asked others – including Overstock subsidiary tZero – to voluntarily hand over information related to their token sales.

Last week, the SEC put cryptocurrency exchanges on notice, warning them that it is a violation of federal law to list security tokens without registering with the SEC and that it is also illegal to list security tokens whose issuers did not register as such with the SEC.