On my latest couple of articles I’ve been kind of focused on Bitcoin and its underlying technology, the blockchain. I discussed the lightning network, why I see Bitcoin as the King of Kings and, of course, why so many people mistake blockchain for DLTs.

It’s time to take these articles one step further and look into different technologies and projects.

I’m also going to completely ignore price for a while, as I’m not a professional trader (nor investor), and I know technology and price rarely come hand-to-hand.

Also, I’m going to assume a great deal of you have lost during the last couple of months, so I’m going to give you my rather positive outlook for the medium-term and why this technology is unstoppable; meaning, if you hodl your crypto, you’ll eventually see some profits.

Unless you mistakenly invested in absolutely shitty ICOs.

If that’s the case, just do like a proper ship captain would: accept the outcome and go down with it. It’s pointless to sell an asset that’s +90% devalued. If you disagree, repeat after me:

- I won’t invest what I cannot afford to lose,

- I Will buy low, and sell high.

I tend to see market cycles as mini-bubbles, constantly growing and then exploding, which gives me enough confidence to understand the reality of things is rather generous: if you do follow the above rules, independently of the moment in time you have invested in, there’s a high chance you can still profit from your bags. Just hang on to them a little longer. Some expert crypto-traders agree there could be a rally during October, which could potentially last until the end of the year. Will this be the case? Prices’ history does not repeat itself, but we can surely learn valuable lessons from it.

Now, to the good part.

Which Cryptocurrency Projects Do I like?

As I’ve previously pointed out, some main concerns of people involved in crypto-trading and investing seem to be about scalability and user adoption. Of course, as the two issues remind us of the chicken and egg problem, we could argue: either some major cryptocurrency like Bitcoin or Ethereum scales due to a technological breakthrough, like the Lightning Network, PoS and sharding, or it goes the other way around and people adopt cryptocurrencies due to a number of different reasons, such as the actual need to use a decentralized, peer-to-peer, digital currency – think of Venezuela, Argentina, soon Brazil? – or the fact people like to speculate on highly unregulated markets (as it sort of allows anyone to do major manipulations and just gamble money away).

In line with those issues, I’ll discus two projects which show great potential by promoting different ways to scale: Ethereum and Stellar.

Both remain my top 2 choices, for the time being.

–this article is not financial advisement as it represents my personal opinion and views only. I have savings invested in cryptocurrency so take whatever I write with a grain of salt. Do not invest what you cannot afford to lose and always read as much as possible about a project before investing. Never forget: with great power comes great responsibility. Being your own bank means you’re always responsible for your own money. No hesitation, no surrender–

Ethereum

The first real bitcoin contender, as so many of you like to put it.

The playground of ICOs. The magic land of assets tokenization, where anything is possible.

I remember at some point people talking about the flippening, when Ethereum would surpass Bitcoin’s market valuation.

(and then you want me to think we behave rationally? Good lord)

Ethereum was the project that really drove my curiosity about cryptocurrencies. The first paper I actually digested was Ethereum’s; and, oh boy, did I like it!

The concept of tokenizing, virtually anything, made my feeble little brain explode with ideas. And I wasn’t alone, as the more I felt down the rabbit whole, the more projects I would find taking advantage of a new way to create value.

If you’ve been here long enough, you’ve heard about a million master-gurus saying something like:

The Ethereum Ecosystem

Although I do enjoy thinking how wonderful it would be to have a decentralized world where all materials, products and things in general could be registered into a blockchain, I wonder “how useful would that really be?”.

I do not doubt there are projects in ethereum like Modum or Wabi, which aim at actually making a significant impact on how supply-chain management and distribution businesses operate (in terms of transparency, that is). Is it working? How far have they gotten? Is there a real need for these types of applications?

There are quite a few mixed opinions on the matter, but the truth is, success depends greatly on adoption; and adoption depends on either speculation or rewards.

A quick visit to WaBi’s website, for example, shows a business that registers milk-products onto an immutable and transparent ledger, so that citizens in China can feel safe about buying milk for their babies. This is actually a huge deal.

But, what about user rewards? Loyalty points, insurance schemes and other partnerships don’t seem the right way to go, according to some opinions. You might even ask if a blockchain is needed for that sort of rewards distribution. Does this company really need a token in their ecosystem?

If we are to live in a non-authoritarian system, then I see not one single currency, but a plurality of cryptocurrencies, behaving differently according to its proposed intentions. You can have assets, some behaving like stock (paying dividends and such), others giving its users the power to vote within a given community, or even allowing people to register information (land? deeds? In-game items?) representing a physical or virtual asset. Whatever end-result you want to achieve if you can do it through decentralization, by giving a proper incentive to your user base, isn’t that what matters?

It’s a win-win scenario. The more companies compete to provide better incentives, the merrier. There are more twists and turns around the proper application of rewards and their ultimate effectiveness, yet, the underlying hypothesis of decentralization and community-driven collaboration is on the assumption the more you give, the more you receive: it has been discovered, apparently, we are not single-minded beings focusing simply on our well-being and maximizing our utility; at least not one hundred percent of the time. Nor we base our decision-making process on rational thoughts.

If by using some application (like sharing resources) I can now easily receive rewards, loyalty points in the form of tokens, and I can also trade those assets for one another who’s to dictate what the real value of anything is?

To answer the question of Ethereum’s real value (and utility), as a medium to create and exchange value, we need to first understand the goal of its currency.

The Purpose of Ether

Recently, an article arised around the usefulness of Ether. The gist of the whole thing was that the Ethereum network should allow for different tokens to be accepted to pay for gas, which would undermine the need for a native currency.

I admit, at first i saw it as nonsense. Why would anyone want to accept erc20 tokens? They’re just a mask on top of ether, using its core functionalities. In my mind I’ve always seen Ethereum as a framework, or a toolkit, allowing developers to create products on top of a decentralized network. Of course we’re still in its infancy, and due to the “lack” of perceived progress, people tend to come out with strong-minded arguments on the value of things. I remember the exact same line of argumentation when the colored bitcoin update was being discussed.

Still, isn’t the author’s critique valid? What is the value of Ether, if there isn’t a need to pay fees with the network’s appointed currency?

None whatsoever.

If we all choose to not use Ether and instead some ERC20/223/etc token, while at the same time miners also accept those tokens as a payment for including a certain transaction into a block, then there is no purpose for Ether (except if people still want to use it).

As Vitalik puts it:

In Ethereum as it presently exists, this is absolutely true, and in fact, if Ethereum were not to change, all parts of the author’s argument (except the part about proof of stake, which would not even apply to Ethereum as it is today) would be correct.

Ether’s current value is to secure the network. In the long-term, when Casper, sharding and atomic swaps are all in place, then I see no reason for people to be subjugated to using Ether to pay for gas fees. Let them use whatever cryptocurrency they want.

The purpose of Ether is to pay block creators for helping us reach consensus. Hence, even if we allow users to pay fees with tokens, miners will receive block rewards in eth. Which they will need to sell to convert into btc, usd, etc. If there are no buyers, then what happens to the price?

It goes down the sink. And no miner/staker (when PoS arrives) wants to hold a devalued asset. We would then have to allow for multiple tokens to be awarded to miners for creating blocks, as well.

This whole idea seems way too troublesome, to be honest. Why wasting time complicating everything? If there is pressure from both the user and miner communities to allow for other tokens to be paid as gas, then the development team should probably heed the call. Even though my gut tells me the likelihood of said proposal having a devious intent would be great, in fact.

Until then, why bother?

At the end, what do you do with that kind of information? I mean, if that happens to Ether because people prefer to use tokens, then so be it.

Isn’t that the purpose of decentralization? To allow people to chose?

At the same time, I would argue there are few too users who actually care about tokens or dapps.

State Of The Art Decentralized Apps

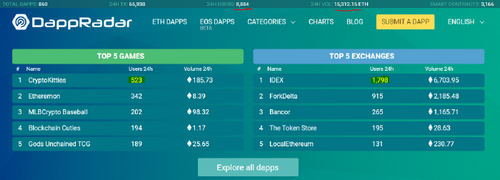

A mandatory metric for success, as we’ve seen above, is user adoption.

That’s not the case for Dapps, at least during the time of writing.

Just by looking at dappradar, a website focused on showing statistics about decentralized applications, we clearly see there isn’t much adoption yet.

Meaning, although I absolutely agree with the author’s concern, it seems a tiny bit too soon to jump into any sort of conclusions.

Some takeaways from an amazing data scientist are:

- We are orders of magnitudes away from consumer adoption of DApps. No killer app (outside of tokens and trading) have been created yet. Any seemingly “large” DApp (ex. IDEX, CryptoKitties, etc) has low usage overall.

- All of the top DApps are still very much about speculation of value. Decentralized exchanges, casino games, pyramid schemes, and even the current collectible games (I would argue) are all around speculation.

- What applications (aside from value transfer and speculation) really take advantage of the true unique properties of a blockchain (censorship resistance, immutability of data, etc) and unlock real adoption?

- For new protocol developers, instead of trying to convince existing DApp developers to build on your new platform - think hard about what DApps actually make sense on your protocol and how to help them have a chance at real adoption.

- We as an ecosystem need to build better tools and infrastructure for more widespread adoption of DApps. Metamask is an awesome tool, but it is still a difficult onboarding step for most normal users. Toshi, Status, and Cipher are all steps in the right direction and I’m really looking forward to the creation of other tools to simplify the user onboarding experience and improve general UI/UX for normal users.

Even my project’s website, Bityond, gets more hits per day than some of these dapps. Why are we so hasty to pass on judgement?

I would think if users are rewarded their incentive would be to participate in as many networks as possible. Hence, crypto-projects might not necessarily be competing for users; there’s loads of room for Ethereum, EOS, IOTA, NEO and others to grow without trying to slam down competition.

There should be little room for maximalism of any kind, as it defeats the purpose of innovation.

Be classy, ladies and gentleman. We’re all on the same boat whether you like it or not. Don’t bash each other’s projects. That adds little value to the community.

Ethereum’s future?

I know price action is the major roadblock for adoption; but the underlying values Ethereum holds and the constant development being done on its EVM, keep me quite optimistic about this protocol.

This is how cycles behave. When smart-money comes back again and the rest of the herd follows, then we’ll see projects releasing better updates and more positive news coming around. Let us be patient and wait for the bearish cycle to end.

Projects that have no purpose will most likely go away and investors learn two important lesson:

A) companies take time to build and,

B) You’re likely to make some bad choices in your lifetime.

If you still need convincing about the seriousness of this protocol, and you happen to be a big data lover, check out this tool released by our dear friend google, which let’s you run big-data queries on the ethereum ledger. It’s absolutely awesome. The way it works is very simple, as explained previously by CCN:

The purpose of making the Ethereum blockchain data accessible on Google Cloud is to make all data stored on the blockchain easily accessible. While Ethereum’s software contains APIs for functions that can be accessed randomly, such as checking wallet balances, the API endpoints are not easily accessible for all data stored on the blockchain.While API endpoints do not enable viewing blockchain data in aggregate, BigQuery’s OLAP features enable such analysis. The blog displayed a chart showing Ether transfers and transaction costs year to date, aggregated by day. Such visualization supports tasks like prioritizing changes in the Ethereum architecture, should an upgrade be needed.

Bonus: Stellar

I had to throw Stellar into the mix, as I really like how it works. Not only because I’ve played around with stellar labs and the documentation was incredibly detailed, but also because I think it’s a serious contender to Ethereum and Bitcoin – although it is more centralized from a governance’s perspective.

Not that stellar replaces any, as it clearly doesn’t, but it can be used as an alternative by institutions and corporations to access the power of blockchain and trade amongst themselves; at least for the time being.

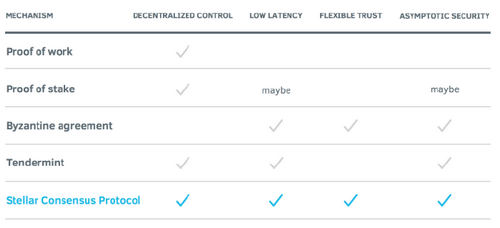

The way the stellar blockchain works is that it reaches consensus through slightly different mechanics than proof-of-work – called Stellar Consensus Protocol. It simply builds on the Federated Byzantine agreement which brings open membership and decentralized control to Byzantine agreement = Anyone can join and vote for the Federated nodes.

FBA determines quorums, or groups of nodes sufficient to reach agreement, in a distributed way. Each node decides which others to trust. Different nodes don’t need to rely on the same combination of trusted participants to reach consensus.

In FBA, each participant knows of others it considers important. It waits for the vast majority of those others to agree on any transaction before considering the transaction settled. In turn, those important participants do not agree to the transaction until the participants they consider important agree as well, and so on. Eventually, enough of the network accepts a transaction that it becomes infeasible for an attacker to roll it back. Only then do any participants consider the transaction settled. FBA’s consensus can ensure the integrity of a financial network. Its decentralized control can spur organic growth.”

Parties who have nodes need to be identifiable, not users, and you chose which line of trust you want to enable. It’s not as decentralized as one would hope, but then again we can’t have it all. Rather, i still prefer Stellar’s openness and transparency to NEO’s – especially as the later is not censorship resistant.

And Lumens?

As Stellar is a blockchain it needs a cryptocurrency; the Lumens (xlm),allow users to write transactions onto Stellar’s blockchain. These transactions also work as smart-contracts, in a sense you can create trust-lines to crowdfund a new asset (token) or release company shares, create bonds, or any many other types of financial instruments.

Stellar, as mentioned above, is nowhere close to being similar to Ethereum, or even bitcoin for that matter; a former fork from Ripple with a nicely tweaked consensus protocol and a set of huge corporations backing it up.

A great example of Stellar’s use-case is the partnership with Veridium Labs, in order to sell carbon offset tokens on the Stellar blockchain. Each company has a role here with Veridium setting up the structure and determining the value formula. Stellar acts as the digital ledger for the transactions and IBM will handle the nuts and bolts of the trade activity of buying, selling and managing the tokens.

Hope you’ve enjoyed this little piece on two of my preferred projects.

Share your opinion and thoughts down below. Don’t forget to give it a like!

Featured image from Shutterstock.

Follow us on Telegram or subscribe to our newsletter here.

• Join CCN’s crypto community for $9.99 per month, click here.

• Want exclusive analysis and crypto insights from Hacked.com? Click here.

• Open Positions at CCN: Full Time and Part Time Journalists Wanted.